The Scottish Conservatives will challenge the SNP to keep their promise to the Scottish people and not raise income taxes as promised in their 2016 manifesto.

The Scottish Conservatives and the SNP campaigned on manifestos committing not to raise income tax.

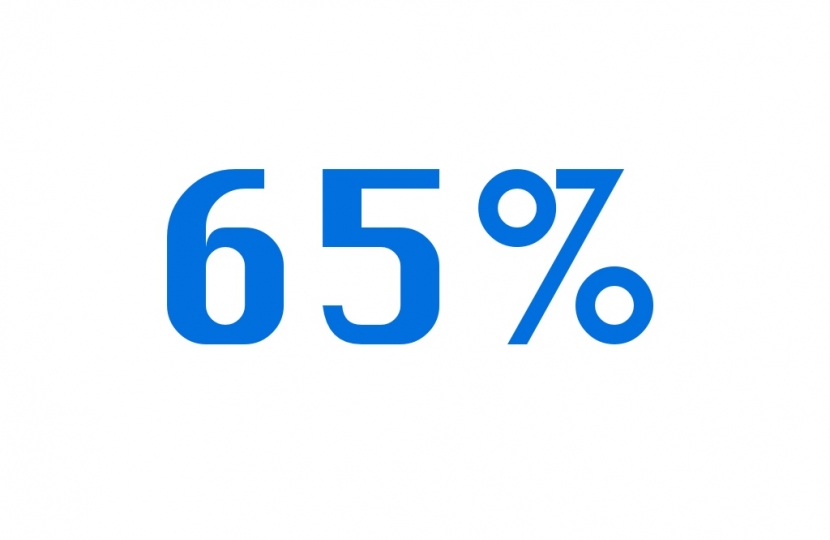

Therefore, at the last election, 65 per cent of the Scottish public voted for parties opposing any increase in the basic rate of income tax.

The Scottish Conservative motion calls ‘on the Scottish Government to freeze the Basic Rate of Income Tax throughout the Parliament to protect those on low and middle incomes’.

The SNP Manifesto promised that the SNP ‘will freeze the Basic Rate of Income Tax throughout the next Parliament to protect those on low and middle incomes’.

Speaking in the Scottish Parliament, Murdo Fraser, Scottish Conservative shadow finance secretary will say:

“The wording in the SNP manifesto could not have been clearer. It states, and I quote directly: “We will freeze the basic rate of income tax throughout the next parliament to protect those on low and middle incomes”.

“Just before the election in 2016, the First Minister said this: “No tax payer will see their bill increase as a result of these Scottish government proposals”.

“On the 30th of April 2016, she said this: “We are not going to increase tax for low and middle income earners because transferring the burden of austerity onto their shoulders is not the right thing to do”.

“The Deputy First Minister John Swinney said in this parliament on the 3rd of February last year: “I want to say to teachers and public service workers the length and breadth of the country ... that I value the sacrifices that they have made, and that the last thing I am going to do is put up their taxes”.

“In the Scottish Parliament election last year… ourselves and the SNP pledged no increase in the basic rate of tax. Between us, our two parties, the tax payers’ alliance of the Scottish Parliament, achieved some 65 per cent of the Regional List vote. So 65 per cent of Scots voted for parties opposing any increase in the basic rate of income tax.

“Now I absolutely agree with the principle that we should help the lowest paid. That is precisely why a Conservative government at Westminster is aiming to double the personal allowance, which has already increased from £6,475 in 2010-11 to £11,500 in 2017-18.

“This has cut income tax for basic rate payers, for the lowest paid, by £1,005. It has lifted hundreds of thousands of our lowest paid out of tax altogether. We reject the notion that those who have already been helped in this way should be hit with higher tax rises.

“The Fraser of Allander Institute has stated that if we could grow the Scottish economy by just half a per cent more than the UK average then over a decade it would have an extra £1 billion in tax revenue to spend. That is where the Scottish Government should be concentrating its efforts, not in increasing the tax burden on hard-working families.”